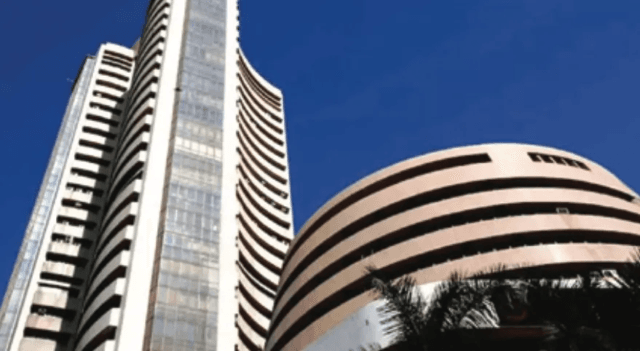

Mumbai, Jun 27: Equity benchmark indices Sensex and Nifty advanced for the fourth straight session on Friday, supported by buying in blue-chips ICICI Bank and Reliance Industries amid fresh foreign fund inflows.

A strengthening rupee against the US dollar and softening crude oil prices in international markets also boosted investor confidence, according to traders.

The BSE Sensex climbed 303.03 points or 0.36 per cent to reclaim the 84,000 level and settle at 84,058.90. During the day, it jumped 333.48 points or 0.39 per cent to 84,089.35.

As many as 2,251 advanced, while 1,760 declined and 154 remained unchanged on the BSE.

On the similar lines, the 50-share NSE Nifty rose 88.80 points or 0.35 per cent to 25,637.80.

On the weekly front, the BSE benchmark surged 1,650.73 points or 2 per cent, and the Nifty climbed 525.4 points or 2 per cent.

“Benchmark indices Nifty and Sensex closed on a firm footing on Friday, capping off the week with robust gains. The rally was underpinned by de-escalation in geopolitical tensions post the Israel-Iran ceasefire and growing optimism surrounding a prospective US-India trade pact, which acted as key macro tailwinds. On a weekly basis, both frontline indices logged gains of 2 per cent,” according to Bajaj Broking market commentary.

From the Sensex pack, Asian Paints, UltraTech Cement, Power Grid, ICICI Bank, Reliance Industries, Hindustan Unilever, Bharat Electronics and Sun Pharma were among the major gainers.

In contrast, Trent, Eternal, Axis Bank and Titan were among the laggards.

Shares of Akzo Nobel India jumped 6.65 per cent to close at Rs 3,405 per share on BSE after JSW Paints Ltd announced the acquisition of a majority stake in the firm.

Sajjan Jindal’s JSW Paints on Friday announced the acquisition of Dutch paint maker Akzo Nobel’s India unit in a Rs 12,915-crore deal to become the fourth-largest player in the paint industry in the country.

JSW Paints will acquire a 74.76 per cent stake in Dulux paint maker Akzo Nobel India for Rs 8,986 crore and launch an open offer to buy another 25 per cent from the open market for up to Rs 3,929.06 crore.

“Key catalysts like the ceasefire in the Middle East and optimism on easing trade tensions ahead of the deadline have cleared the clouds in the minds of investors. After consecutive days of selling, FIIs have turned into net buyers in the domestic market, contributing to improved market stability in the near term.

“Moreover, benign oil prices and a strengthening rupee influenced investors to focus on domestic growth themes,” Vinod Nair, Head of Research, Geojit Investments Limited, said.

The BSE smallcap gauge climbed 0.54 per cent, and the midcap index went up by 0.38 per cent.

Among BSE sectoral indices, oil & gas jumped 1.21 per cent, services (1.17 per cent), power (1.14 per cent), commodities (1.11 per cent), energy (1.10 per cent), utilities (0.99 per cent) and telecommunication (0.90 per cent).

Foreign Institutional Investors (FIIs) bought equities worth Rs 12,594.38 crore on Thursday, according to exchange data.

In Asian markets, Japan’s Nikkei 225 index settled higher, while South Korea’s Kospi, Shanghai’s SSE Composite index and Hong Kong’s Hang Seng ended lower.